The multi-day tour industry has rebounded nicely out of the pandemic, with many operators meeting or exceeding 2019 revenue. In fact, operational and infrastructure challenges have replaced revenue softness as the most immediate challenge, as operators of all sizes attempt to absorb the latest surge of bookings.

Here at Dune7, we’ve seen this first-hand, counting numerous global and regional multi-day tour operators as clients.

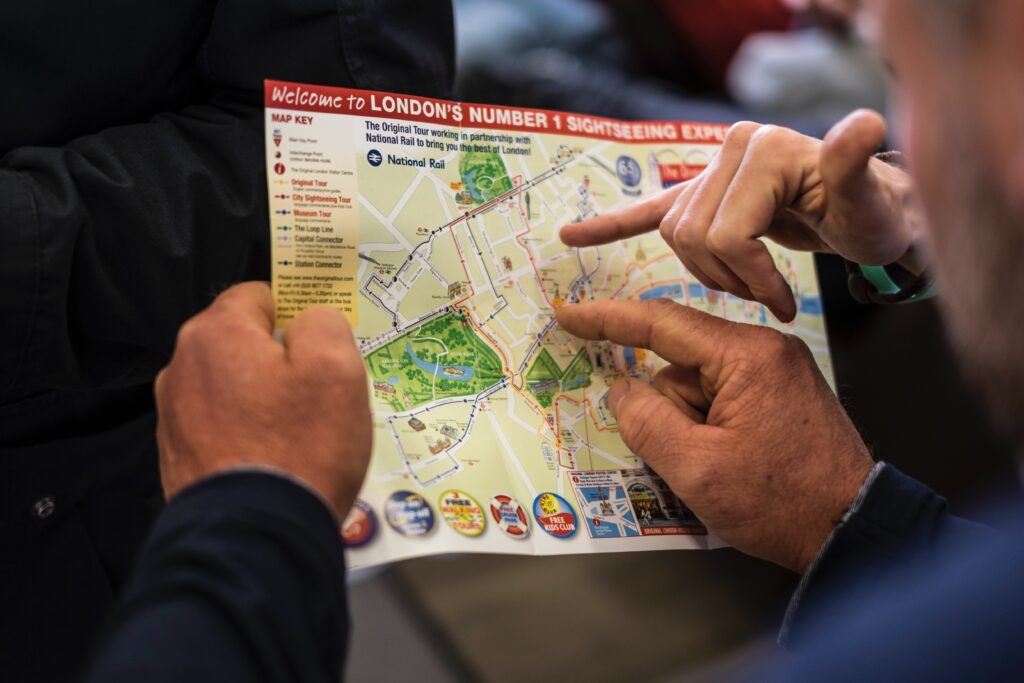

New traveler behaviors and a thirst for “meaningful travel” have shifted booking patterns. Travelers are increasingly choosing destinations based on their sustainability scorecard, uniqueness, and opportunities to get off the beaten path. According to the latest adventure travel snapshot report from the Adventure Travel Trade Association, activities such as hiking, trekking, and walking were the most popular adventure activities coming out of 2022.

We dug into the numbers a bit further to highlight key booking trends across multiple data points including:

- Search intent across destinations

- Conversions and revenue generation

- Predictions going into Q4 2023

Methodology

We compared anonymized data from Google Analytics from January to June 2022 vs the same time period in 2023 for multiple global tour operators. Traditionally, this 6-month period is the key booking window for multi-day operators in the United States. We looked at pageview data at both the specific country and regional level, plus direct e-commerce revenue results (online bookings).

We did not account for revenue sourced from other booking channels such as over the phone, third-party OTAs, or travel agents. However, given the contribution share of the direct channel to total sales, we feel the data is indicatively accurate to portray overall search and booking trends.

In order to normalize the data across suppliers, parameters were determined for both pageview and revenue data. A minimum threshold of $5,000 in revenue per time period for a single destination was applied. For pageviews, a minimum threshold of 100 views per time period in a single destination was applied.

Each data point was tagged with its respective country in order to group individual destinations into regions. For data points tied to multi-destination products, we used the point of origin as our destination classification. Regional classifications used are as follows:

- Africa

- Asia

- Central America

- Europe

- Middle East

- North America

- Oceania

- Polar

- South America

Revealing Regional Insights

Our findings are broken down into results based on pageviews and revenue for destinations at both the regional and country level.

Typically, multi-day tour packages from the US tend to book out 4-6 months in advance (sometimes even longer). Given the analysis was done utilizing data from January through June, it can be assumed that many of these bookings reflect travel dates (departures) during the peak summer months.

However, some of the departures are likely to fall in the traditional “shoulder season” of Q4 (October through December). As summer is notoriously the busiest time to travel, consumers may be looking during the peak booking window, but pushing off their departures for off-peak travel periods.

With many Americans continuing to work remotely, the traditional travel window no longer falls strictly during the Northern Hemisphere’s summer months. Deloitte’s 2023 Leisure Travel Survey finds that remote work has allowed travelers to add as many as six additional days onto their vacation.

Let’s take a closer look at the findings.

Overall, our data shows that direct online revenue has decreased by 22% during the period of January-June, 2023 vs. the same period prior year. However, given our relatively small sample size, this downward trend may not be indicative of the industry at large. Channels beyond online, such as sales from third-party agents, may be contributing more to overall revenue share.

Not surprisingly, Europe received the highest number of total pageviews at the regional level across both 2022 and 2023.

However, Europe saw a significant shift in revenue share from 2022 to 2023. While Europe pageviews were up 104%, revenue decreased by 26%.

This could be for any number of reasons, but signs may point to geopolitics. There may be some reservations about European travel due to the war in Ukraine. According to Forbes, “62% of U.S. travelers cited concerns about the war in Ukraine spreading to nearby countries as a factor impacting plans to travel to Europe“.

Early research has shown that 47% of travelers have been holding off on trips to Europe until the conflict is resolved. Ukraine specifically saw a -51% decrease in pageviews between 2022 and 2023. An increase in airfare and reports of overcrowding in popular European destinations may also be at play here regarding drops in revenue.

The Middle East also saw an increase in pageviews at 203% and a decrease of -26% in revenue YoY.

Middle Eastern countries have been investing heavily in building a global tourism economy. Saudi Arabia alone is looking to spend $1 trillion over a decade with a goal to attract 100 million tourists a year by 2030.

The Middle East’s flagship carriers have also been leading the recovery since the pandemic across passenger load and total airport traffic. Airlines such as Emirates, Etihad, and Qatar Airways are expected to handle 1.1 billion passengers by 2040.

Some of the other findings generally follow what experts are seeing in the industry. With travelers looking for unique experiences, we are seeing a variety of destinations gaining in popularity. This is seen with both intent to book and actual bookings.

In Asia, there was a huge increase in intent (searches and pageviews), +1,392%. Also, a substantial increase in revenue, +53%, between 2022 and 2023.

Asia as a region has been piquing people’s interest tremendously. With fears of the COVID-19 virus on the back burner and many Asian countries reopening their borders to vaccinated Americans, consumers are certainly turning their research into revenue for multi-day operators. As travelers are becoming confident once again in booking long-distance travel, Asia has been at the top of the list for many. Vietnam and India are in the top 5 with the highest percent increase in growth in revenue. This data suggests that tourism in Asia is on an increasingly strong rebound.

Africa also saw a large increase in both pageviews (114%) and revenue (65%) between 2022 and 2023. As the world is increasingly opening up post-pandemic, American travelers may be more confident in their travel and therefore looking farther afield.

Other regional findings

Central America saw the highest increase in revenue of any region at 195%. While North America, on the other hand, saw the highest drop in revenue at -92%. In 2022, many Americas sought to travel close to home as they were feeling timid about going abroad. This year, many more consumers are opting to travel abroad and the data reflects this.

Country Correlations

Our country-level data spanned 108 different countries.

Many popular countries for multi-day tour takers, such as Greece and Italy saw relatively stable numbers in both revenue and page views from 2022 to 2023. However, several countries in Europe saw a decrease in revenue between 2022 and 2023. For many countries, pageviews are still positive, showing that intent remains.

- Greece: 35% increase in revenue, 142% increase in pageviews

- Italy: 95% increase in revenue, 112% increase in pageviews

- Spain: -21% decrease in revenue, 123% increase in pageviews

- Portugal: -38% decrease in revenue, 162% increase in pageviews

- France: -31% decrease in revenue, 144% increase in pageviews

There were several increases in revenue seen in our data, most notably being Costa Rica (831%). Other substantial increases in bookings were seen in India (545%), Vietnam (607%), and Peru (327%).

Looking at the top 5 countries by growth in revenue, not one is located in Western Europe, the typical hot spot for American travel abroad. Our country-level data supports the regional trends in the assumption that Americans are looking further afield to more exotic destinations. Although consumer motivation may be changing, international travel demand remains high.

Japan was a clear leader in increased interest and intent with a 3,146% increase in pageviews between 2022 and 2023. This jump was far beyond any other country with the next highest increase in pageviews being Israel at 436%.

Japanese food and culture have long been a draw for many travelers, as well as its rich history and beautiful landscapes. Japan was one of the last nations worldwide to reopen its borders, which finally happened in June of 2022. However, it was a conditional reopening catering only to tourists who were on chaperoned package tours with required visas.

The data showing increasing revenue at 55% for Japan suggests that the reopening restrictions benefited multi-day tour operators.

Peru is once again on the rebound, following protests that erupted nationwide in winter 2022/2023, trapping approximately 300 tourists in the ancient city of Machu Picchu.

In Central America, Costa Rica has long been a popular destination for many Americans due to ease of access from the United States, the allure of deep jungles and beautiful water, and is made for longer, slower trips. Costa Rica is also traditionally seen as a very safe Central American destination. After spending the lockdown staring at Instagram feeds of beautiful destinations, it’s no wonder that many travelers are booking a tour in Costa Rica.

Overall Conclusions

Consumers are regaining confidence in travel and are shifting their preferences to satisfy an increasing desire to explore off-the-beaten-path destinations. With travelers seeking unique and authentic experiences, emerging destinations have a chance to capture their attention. Tour operators are in the perfect position to offer such experiences and may continue experiencing strong interest and bookings into 2024.

As we look forward to the upcoming shoulder season and 2024, some challenges remain. Many Americans are using their savings from the pandemic era to fuel their once-in-a-lifetime trips to places such as Asia, Africa, and Central America. With the summer travel season coming to a close and predictions by some of the US economy falling into a slight recession, will the boom continue?

Multi-day traveler demographics are traditionally “healthy and wealthy” so are not always impacted by economic downturns. Evolving preferences and our data suggest the travel boom is not just a temporary phenomenon but a reflection of a broader shift in the industry. Consumer spending remains strong and with inflation under control, multi-day tour bookings may not be impacted.

As we move forward, it is crucial for operators to recognize and leverage trends to accommodate the ever-shifting needs and desires of travelers. Operators should continue to invest in analytics to understand search intent and booking trends, and be flexible enough to pivot marketing tactics in order to take advantage of changing behaviors.

No comments.