How to take back control of your digital acquisition

Google & Facebook won in 2019. That much is sure.

These two digital advertising behemoths, with more than 50% combined market share, continued their dominance.

Nowhere is this more prevalent than in travel.

Many companies spend a considerable amount of their marketing budget with either Facebook, Google, or both. At the top, companies like Booking Holdings and Expedia Group spend billions of dollars with Google annually. This is despite Google making inroads on competing digital travel products of their own (more on that below).

Over at Facebook, positive revenue trends continue as travel marketers pour money into the platform to reach customers at scale. But, Dune7's research shows that marketers are perhaps discounting the lackluster performance in the travel category as a whole.

Google grows, encroaching further on brands' territory

Google is slowly but surely growing its Flights and Hotel products, dominating organic search while forcing brands into their paid products. The search giant's hotel finder has alone doubled in size in one year from 2019 to 2020. This explains the vast increase in paid links in SERP’s meaning less organic real estate for direct brands to rank.

Small, independent, and boutique hoteliers have their work cut out for them more so than their larger competitors. With page one of search dominated by Google products and paid ads.

2019 also marked the year when Google entered the short-term vacation rental space, with a meta play featuring inventory from VRBO, Expedia, and Hotels.com, to name a few.

Although Google has shuttered its Trips and Touring Bird products, the reprieve might be short-lived for the tours and activity segment. The functionality from these products lives on in other Google products, such as Maps. Depending on the specific search term, Google still likes to favor their own content in position ‘0’ before presenting the first truly organic result.

Overall, nearly one-third of the top 100 most common searches direct primarily to a Google product or service.

Bottom line is that Google is here to stay. It views travel as a massive opportunity as it tries to claw more revenue per user.

Facebook dominant, despite trust issues

Consider this: despite all the hoopla surrounding Facebook relating to data privacy and Congressional hearings, revenues from advertising continued to climb through much of 2019.

Travel remains one of the most popular categories for both organic and paid content on the platform. But consumption of Facebook content overall is actually on the decline.

Consumers still spend relatively more time on Facebook vs. other social apps. However, according to eMarketer, we’ve already reached ‘peak Facebook.' Average daily engagement is forecasted to remain stagnant in the near future.

Meanwhile, the macro stats for travel advertisers on Facebook are not promising.

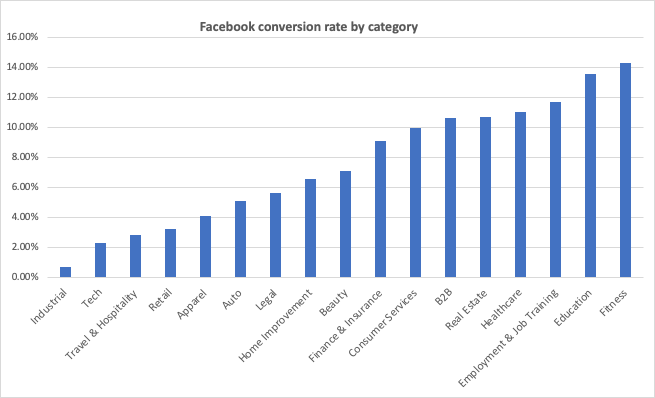

Travel ads as a category receive low click through rates (CTR) at .90% when compared to other verticals like retail (1.6%). Conversion rate metrics in travel fare even worse, with an average conversion rate in the 5th percentile.

Travel ads on Facebook also have the dubious honor of costing 22% more on average, based on total cost per action (CPA). This is according to the digital marketing specialists at Wordstream.

The OTA shakeup

In November 2019, Mark Okerstrom was ousted as CEO of Expedia in the face of poor Q3 results and a flawed brand repositioning strategy. Consensus from the trade press points to Expedia experiencing an “incremental weakness” in organic search as a major factor. Basically, the company became overly reliant on expensive paid ads.

As stated above, this is symptomatic of the new media landscape - where Facebook and Google capture the majority of online global ad revenue.

Opinions from the OTA keynotes at the Phocuswright Conference in November 2019 mirror this general dissatisfaction with Google. TripAdvisor, who has experienced a significant decline in traffic and hotel revenue as a result of ongoing pressure from Google, offered their counter strategy.

According to WIT Editor Siew Hoon, TripAdvisor CEO Steve Kaufer described the new strategy to mitigate the company’s exposure, saying:

“We have to build better products, better value proposition so that the next time you want to plan a trip, you come to us.”

Steve Kaufer, CEO TripAdvisor

Just before this article was published, TripAdvisor announced 200 layoffs, with a hit to their fledgling Experiences sector.

Bryan Dove, CEO of flight search tool Skyscanner, who have undergone a recent rebrand and pivoted to a marketplace from meta search, is quoted as saying “it’s less about guessing what they [Google] are going to do next, but it’s our challenge and opportunity to ensure we offer enough value and product that they stay with us rather than go back to Google for the next search. We have to build something consumers will love.”

Many companies, such as Booking.com, have already taken action to counteract the ‘Google effect.' They are reallocating budget from Google Ads towards content and brand marketing to drive their next phase of growth. In 2019, Glen Fogel, Booking Holdings CEO, announced a 41% quarterly increase in brand marketing vs. the same period, prior year.

While Booking pivots to brand and TV, Expedia has also increased their brand marketing push, with a spend of over $100 million for 2019 (Expedia brand only). Expedia also began to focus their messaging on tours and experiences, like this spot below from 2019.

Digital marketing ideas for tour operators and travel companies

Despite these significant industry events of late 2019, there is a steadier course for 2020 when it comes to digital strategies and acquisition.

Here’s a list of digital marketing strategies and tactics to consider:

- Before diving into performance activity, create a solid organic strategy with SEO and content marketing at its core. Then, go ahead and supplement with paid for terms where you still don’t rank.

- Make sure your technical 'on site' SEO isn't hurting your visibility in organic search. We're talking stuff like meta tags, javascript rendering, internal linking, and href lang tags. Sound foreign? Get a technical audit in 2020.

- You wouldn’t build a roof without first having a solid foundation, and the same should go for your acquisition strategy. At Dune7, we call these Sustainable Strategies.

- Building authoritative, high DA links still matter - even in 2020! Use tactics such as Digital PR and Outreach to build connections and links through influencers and the press.

- Leverage content and brand marketing as ways to clearly position yourself against competition. This will in turn make your paid efforts more efficient.

- Affiliate marketing is a tried and true channel, but can take some time to build out a network of quality publishers. Try Commission Junction if taking the network route. Or, create a bespoke program, assuming you have the in-house expertise.

- Start a two-way dialogue with your customer and become part of the conversation. Engage and pull them in via inbound marketing, vs traditional advertising which is ‘push’ or ‘outbound’ marketing.

- Think about quality content, not just shear volume, that goes beyond the blog post (yes, we realize the irony in that this is a blog post) 🙂

- If you’re a marketer or executive of a large company, ensure everyone on your team in every office knows how to communicate your brand. Consistency is key, as is adherence to a single style guide.

Some final thoughts

Thus far, Google has not flexed their muscle when it comes to multi-day tour products. Flights, hotels, and now short-term vacation rentals have been infiltrated. It's anyone’s guess how long tour operators will be able to escape the same fate.

Already, Google has already made inroads as an intermediary between consumers and tour & activity suppliers with recent changes to their travel pages and Google Maps content. At the same time, Google has recently implemented direct connections to tour & activity reservation systems, such as Peek Pro and Rezdy. This should have the effect of cutting out OTA’s as the intermediary, thus saving suppliers hefty commissions.

Now is the time to shore up your organic, content, and brand marketing strategy to avoid making costly pivots in the future.

You don’t need to be on page 1 for every term. Look at your product mix from a commercial and revenue perspective, paired with a data-informed analysis of consumer intent. This is a great place to start prioritizing your keywords.

Ditto with your brand strategy - if it’s been a while since you’ve looked at your style guide, dust it off! If you’re unsure of your brand’s position and messaging, it’s worth the investment in both time and money to get it dialed in. Consumers’ expectations are changing and they’re gravitating towards values-based brands that stand for something (think Airbnb, Bombas, Intrepid Travel, Patagonia).

We’re not recommending or suggesting that you ignore Facebook and Google ads.

Both platforms offer tremendous scale, high intent in the case of Google, and decent targeting options. According to a recent study from Arival and BookingKit, more than half of travelers (56%) say they used Google to research tours and activities. This behavior likely won’t change in the near future.

However, for tour operators, competing in Google Ads means you have a truly unique product offering with low competition. Or, you're lucky enough to have a large budget to consistently outbid your competitors.

Before attempting to spend your way to success, there’s no time like the present to start building your organic, content, and brand strategy. The Dune7 team is here to help.

No comments.